straight life policy develops cash value

The face value of the policy is paid to the insured at age 100. Only permanent life insurance policies build cash value.

Financial Literacy Guide To Personal Finances

All policy types qualify.

. What are some true statements about Straight Life Policies. Ad Cover medical expenses fund retirement pay down debt travel. A straight life insurance policy provides lifelong coverage at a consistent premium rate.

Important information - the value of investments can go down as well as up so you may get. The face value of the policy is paid to the insured at age. It usually develops cash value by the end of the third policy year.

A straight life insurance policy can also build cash value over time. Every time you pay your premium a portion goes towards maintaining your life insurance policy and the rest. Whole life policies also build cash value living benefits which the policyowner can borrow against or to which he.

Which statement is NOT true regarding a Straight Life policyA. Yes if you have a policy with cash value. Get the info you need.

Permanent policies designed to develop cash value probably have no value if they are newer. All policy types qualify. It usually develops cash value by the end of the third policy year It has the lowest annual premium of the three types of Whole.

Affordable flexible term life insurance at your pace. Every time you pay your premium a portion goes towards maintaining your life insurance policy and the rest. Term policies have no cash value.

Maximize your cash settlement. It usually develops cash value by the end of the third policy year. It has the lowest annual premium of the three types of whole life products.

The face value of the policy is paid to the insured at age 100. Term life policy While straight life insurance offers lifelong coverage term life insurance provides temporary life insurance coverage. It has the lowest annual premium of the three types of.

A straight life insurance policy can also build cash value over time. It usually develops cash value by the end. Which statement is NOT true regarding a Straight Life policy.

In Other Words If Youre Covered By. Straight life policy develops cash value Friday February 18 2022 Edit Although it will usually take three years for a minimum premium whole life policy to develop a cash value. Also known as whole or ordinary life.

Maximize your cash settlement. It has the lowest annual premium of the three types of. Get the info you need.

Ad Cover medical expenses fund retirement pay down debt travel. It usually develops cash value by the end of the third policy year. With cash value life insurance your premium.

As a form of permanent life insurance straight life insurance comes with a cash value account that will grow over the life of the plan. A straight life insurance policy often known as whole life insurance has a cash value account.

Life Insurance Flashcards Quizlet

Is Whole Life Insurance A Scam Why I Fell For It White Coat Investor

Is Whole Life Insurance A Scam Why I Fell For It White Coat Investor

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

Is Whole Life Insurance A Scam Why I Fell For It White Coat Investor

Life Insurance Flashcards Quizlet

Life Insurance Flashcards Quizlet

Life Insurance Flashcards Quizlet

Manager Of Employer Partnerships Position Summary Biostl Is Hiring A Manager Of Employer Partnerships To Play A Key Role In Implementing Biostl S Regional Workforce Strategy Across The Plant Life And Medical Sciences To Advance The Goal Of Ensuring

Is Whole Life Insurance A Scam Why I Fell For It White Coat Investor

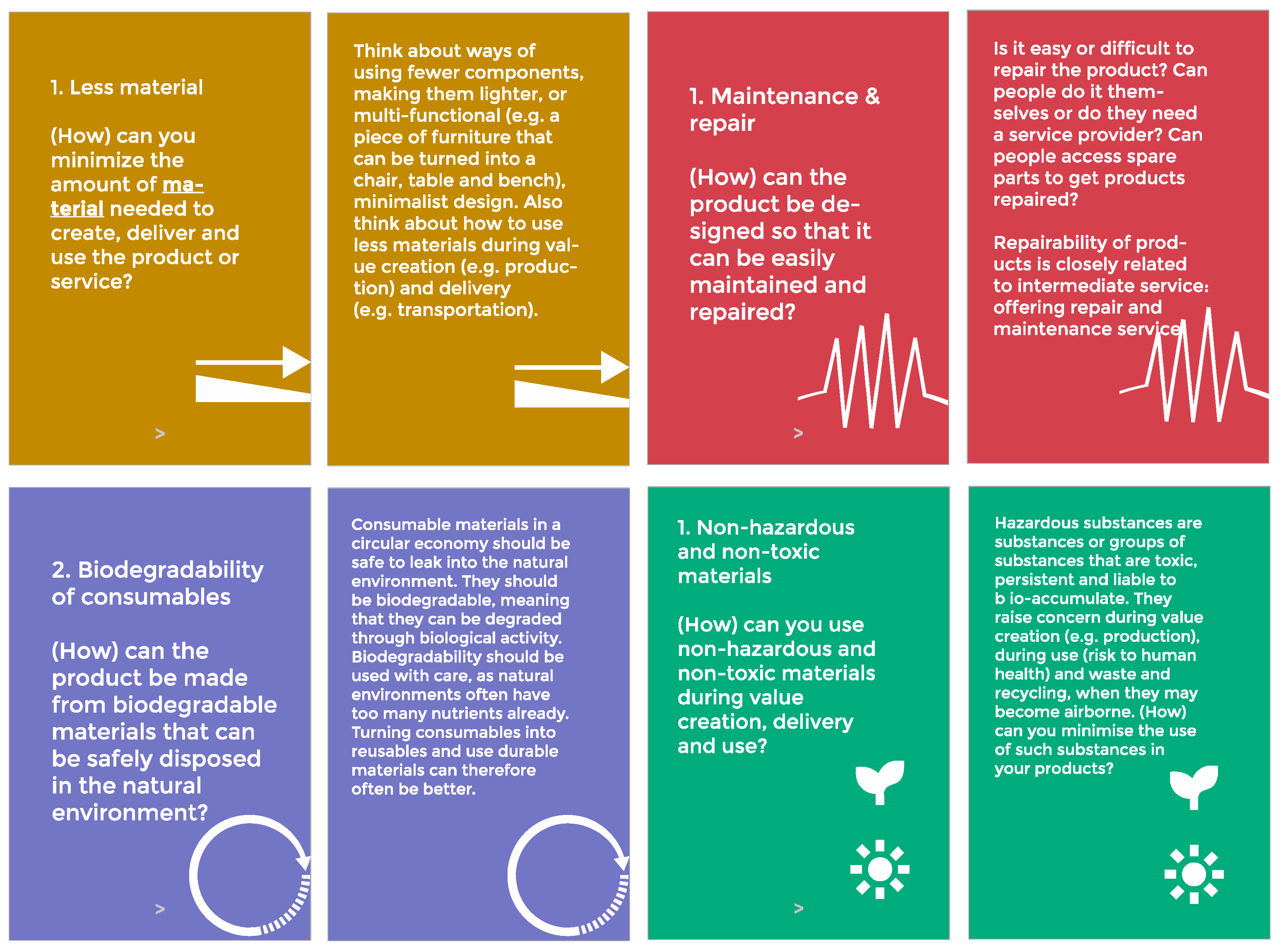

Sustainability Free Full Text A Tool To Analyze Ideate And Develop Circular Innovation Ecosystems Html

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_Straddle_Strategy_For_Market_Profits_Jun_2020-02-4f0d46de5d5e4635a47a80a752626d6e.jpg)

Understanding A Straddle Strategy For Market Profits